By Stephen Parker, AIA, NCARB

Behavioral Health Planner, Stantec

Editor’s Note:

Parker is an architect & behavioral health planner at Stantec in Arlington, VA. Stephen served as co-convener of the AIA’s Strategic Council’s Mental Health and Architecture Incubator and is an AIA Bethune Fellow, HCD Rising Star, AIA Young Architect Award Winner & Co-Founder of HD’s Young Architect Roundtable.

Much ink has been spilled on the nation’s student loan debt crisis, yet its impact on the architecture profession has deeper dimensions. As a relatively small professional class whose next generation of talent has come of age during a series of society-wide crises, its ramifications are just beginning to be understood. Ranging from the Great Recession to the first Global Pandemic of the century, this next cohort of aspiring architects are also living with sky-high student loan debt compared to earlier generations. Taken together, this confluence of crises will have repercussions well beyond our lifetimes.

With over 45 million American graduates living with a student loan debt of some kind, totaling $1.5 trillion, it’s a debt that is only surpassed by home mortgages in this country. Arguably this debt is reaching untenable levels and has only been temporarily alleviated during the pandemic. This unexpected savings has unleashed a significant amount of pent-up demand and disposable income, bolstering a slowly reopening economy. How long that economic rebound will last once loan repayments are reinstated by the federal government is anyone’s guess.

In this context, architecture students, recent graduates, and emerging professionals are living with student loan balances that average 10-33% (depending on degree program type) above the national average. Combined with still-recovering economies and communities, debt is causing many architectural graduates to consider leaving the profession. This would deprive the field and the country of the designers needed to build a carbon-neutral future. This is evident in the strained labor market the industry is currently experiencing, finally pushing up wages to compete against inflation and the pent-up demand of a global pandemic. During the Great Resignation, as it is called, the lasting effects of this labor dynamic are yet to be determined.

Our predicament is now preventing graduates from pursuing their dreams and contributing to providing service to the greater good of society as we struggle to raise income and repay high levels of student debt compared to starting salaries. This has had a huge impact on the diversity in the design professions.

Billie Tsien put it best:

“The biggest problem and opportunity facing the profession of architecture is diversity. And one of the causes is expensive graduate school with not necessarily any payoff in the end. Leaving school $200,000 in debt, and the prospect of a job that might pay $65,000 a year, is daunting to anybody.”- Interview, Curbed

Architecture graduates often rate the enormous burden of high student loan balances as one of the most overwhelming obstacles to developing meaningful careers. It is crucial that not only architecture students and recent graduates but the entire profession needs to get involved in the dialogue around the impact of student loan funding. We should continue advocating for policies that keep graduates active in the profession and enable them to serve their communities in meaningful ways.

The results of such high student loan debt can have lasting professional and personal repercussions. In 2017, the NDSA Coalition launched a survey and social media campaign, collecting and sharing personal stories and quotes from architecture students and recent graduates. Here are a few of those stories:

“We need help raising the low salaries for architects nationwide.”- Anonymous Survey Respondent

“All other student loan repayment options I’ve explored do not have a back-up plan like the federal program which includes the income-based option in event of job loss. I wish for a way to refinance my loan to current market interest rates. Interest is rarely talked about in student loans.” – Anonymous Survey Respondent

“After I graduated, I did not find full-time architectural work for almost 3 years, so I worked in a combination of unrelated jobs and freelance designing to continue paying for my student loans.” – Anonymous Survey Respondent

Awareness

As with complex issues surrounding personal finances with wide societal impacts, student debt within the architectural profession suffers from a lack of awareness and understanding. Often recent graduates and younger staff simmer over these issues without firm leadership ever being aware.

Generally, student loan repayment is typically a larger percentage of recent graduates’ take-home pay. The most common rule of thumb is to have your student debt equal your starting salary. With stagnant wages and ever-rising levels of student debt, this equation is increasingly out of balance. With most architecture students facing down $10,000 more in student loan debt than the national average, the lower starting salary compared to peer professionals means major life stages are delayed as well. Milestone investments such as buying a car or buying a first home require down payments that student loan payments eat away at. Putting off the expense of weddings or having children become part of the calculus of balancing the monthly loan repayment versus long-term life goals. The economy suffers as a result, and the careers of aspiring architects are no exception.

Diversity issues will become even more exacerbated with ever-larger student loans, with a profession further removed from the society we serve. Given the recent wave of JEDI (justice, equity, diversity, and inclusion) efforts have unleashed a host of new scholarships and programs, it’s only scratching the surface of how to create a more equitable composition of architectural classes and diverse firm staff. Yet the underlying unaffordability of the profession is only part of the equation. In most states, an accredited architecture degree is a 5-to-6-year proposition, longer than most large scholarship programs support, meaning more loans to cover the additional semesters. Coupled with the extensive hours required for studio and additional material expenses, holding down a job or underpaid internship is difficult for even well-supported students. (To be clear, unpaid internships go against both NCARB’s and AIA’s membership policies). If a student’s support network isn’t robust, that student is even less likely to make it through the rigors of architecture school, internships or complete licensure. Student debt compounds those issues even further.

The long-term impacts on the profession cannot be understated. Much in the same way the “lost generation” of architects from the early 1990s found their way into other professions and industries, the current architectural profession risks a similar exodus. Even the more recent financial crisis of 2008 and its resulting Great Recession has made staff members with 10 years of experience seem like unicorns. If not managed holistically, our greatest asset, our diverse, knowledge-building, human capital will be further depleted.

Without a robust pipeline of aspiring architects who can rise through the profession, become licensed, and lead firms, succession plans force more firms to close their studios, merge or sell to larger entities. This would accelerate the loss of small- to medium-sized architecture firms that serve rural or smaller cities, and a net loss of small businesses. This would further accelerate large firm consolidation, depriving more opportunities for the next cohort of small firm owners to come to fruition. Other effects include job-hopping and boomeranging becoming the norm, as staff search out higher salaries in the next job. Staff retention and building institutional memory in studios become even more difficult as a result.

Advocacy

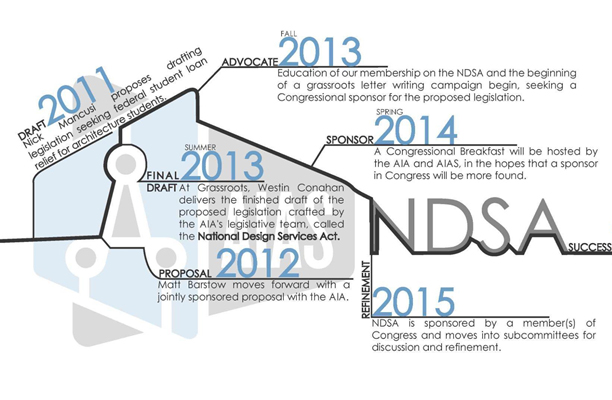

The American Institute of Architects (AIA) and The American Institute of Architecture Students (AIAS) launched a campaign in 2012 to urge Congress to include architecture school graduates in the same federal programs that offer other graduates loan debt assistance if they donate their services to their communities and elsewhere. This effort was called the National Design Services Act or NDSA. Introduced twice in Congress with the help of Rep. Perlmutter (D-CO) in 2012 and 2014, this effort led to the formation of the AIA’s first member-driven grassroots initiative, the NDSA Coalition.

The National Design Services Act (NDSA)

NDSA encourages young architects to play a larger role in the design direction of their community and to increase engagement with rebuilding and constructing for the future. This principle builds on the ethos of the profession and resonates with the architectural graduates.

The NDSA included several goals and benefits, including:

- Community/university partnerships for the research and design of infrastructure improvements that serve the university’s immediate region.

- Assistance to community groups, non-profit organizations, and agencies or public institutions that are representing underserved areas and underfunded projects.

- Professional design and planning assistance for community groups and non-profit organizations

- Architectural and engineering services for community groups and nonprofit organizations early in the project development process.

- Community-benefiting sustainable designs

- Evaluation of existing building conditions

- Identification and address of health, safety, and accessibility issues

While the NDSA sought to create a parallel program model on other professional loan repayment programs, AIA has found other opportunities to address student debt.

“All other student loan repayment options I’ve explored do not have a back-up plan like the federal program which includes the income-based option in event of job loss. I wish for a way to refinance my loan to current market interest rates. Interest is rarely talked about in student loans.” – Survey Respondent

Recently, AIA introduced the Retirement Parity for Student Loans Act, which would allow employers to count an employee’s student loan debt repayment as a matching contribution to that employee’s retirement plan. Any type of student loan and employer-based retirement plan would qualify under the current proposal. Ultimately, the legislation would allow recent graduates to begin saving money for retirement, while also accumulating interest. This act is a novel approach to contend with the byproduct of student loan debt through current financial instruments.

AIA has also suggested supporting the Civilian Climate Corps, a newly proposed $10 billion program that would employ young people for short-term jobs or training programs that focus on renewable technology and building resilience against climate-related threats. AIA has partnered with the American Bar Association (ABA) to highlight how this program could help young people pursue the architectural profession while addressing climate action in a substantive and meaningful manner. It echoes the Civil Conservation Corps of the New Deal and its transformative impact upon the infrastructure of the nation is an aspirational example.

The Civilian Climate Corps mirrors much of the original intent of the NDSA and its community-focused efforts to leverage student debt into an asset for community revitalization & resilience. Civilian Climate Corps builds on the purpose-driven ethos of each graduating cohort that seeks to find meaning in the profession through service and leadership. What better way to build up the profession than on a foundation of service rather than a mountain of debt?

Agency

Ultimately, these large, complex issues create overwhelming odds, and the question becomes how to gain agency at the individual and professional level.

Besides tuition scholarships to lessen the burden on current architecture students, there are becoming more options to address student debt for recent graduates. Firm leadership is recognizing that the burden of debt is deterring many from licensure, additional certifications, or investing in the firm’s equity structure. Some companies are offering student debt repayment as an employee benefit. Indeed, companies can pay more than $5,000 towards their employees’ student loans, per year, tax free under the CARES Act. This is becoming more common at architecture firms (especially larger, well-resourced firms) in an effort to retain staff, compete with peer firms, and help future architects afford the equity buy-in required for firm ownership.

While not every firm can afford such a benefit, there is another way to contribute. The Architects Foundation (AF) is fundraising to establish a student loan relief program for aspiring architects, helping retain the best and brightest in the profession who might otherwise leave the industry. As the philanthropic partner of The American Institute of Architects, the Architects Foundation (AF) attracts, inspires, and invests in a next-generation design community through scholarships and exhibitions. Its mission to uplift the profession includes the Jason Pettigrew ARE Scholarship, the Diversity Advancement Scholarship, and numerous others.

Hopefully, you’ll join us in pledging your support to raise up the next generation of aspiring architects. Hunter Douglas Architectural has pledged to support this effort as part of their Young Architects Roundtable, a group of emerging professionals dedicated to advocating for issues of impact in the profession.

https://network.aia.org/blogs/cindy-schwartz/2016/06/10/ndsa-a-brief-history

https://peoplejoy.com/companies-that-offer-student-loan-repayment/

https://network.aia.org/blogs/cindy-schwartz/2016/06/20/how-does-the-ndsa-work